- Are you a mama’s boy?

More like a mama-and-papa’s boy. My mother, Zoya Borisovna, can hardly be called a regular mom. She has always been a very career-minded and creative person. This side of life was far more important to her than many other things.

In my childhood, my grandparents took care of me most of the time, while my mother showed up at the most crucial moments. From my early years in elementary school, she treated me as an equal and felt obliged to explain the dos and don’ts to me. In my teens, we made a deal I could come home late. And a bit later, I was allowed to stay over at my friends’ houses, if it was too late. But I had to call up my mother and inform her that I wouldn’t be coming home.

- How strong was her influence on you?

Very powerful! For instance, our family greatly valued any fondness for reading and knowledge of classical literature. We had a large library. You were highly encouraged to talk about books, while materialistic subjects were frowned upon. My mother hated talking about money and how much other people earn. She was adamant that it was unworthy of a true intellectual.

- Nevertheless, she gave you money, didn’t she?

When I was in school, she’d give me pocket money. Incidentally, this reminds me of my first business deal, if you will. I still feel ashamed of it… I loved ice cream. My school [Public School No. 444] had an advanced curriculum in physics and math, and was situated six streetcar stops away from the place where we had lived. I ate ice cream every day – even on frosty winter days. After school, I’d hurry to buy ice cream and I’d wolf it down during the streetcar ride home. And I would have another one after getting off at my stop to walk home. Naturally, I did not feel hungry enough to have a normal lunch, which made my dear mother terribly upset. One day she approached me with an offer: “Honey, I’ll give you money to buy the most expensive ice cream provided that you bring it home and have it after lunch. What is the most expensive ice cream?” I replied: the ‘Gourmet Delight’ brand. It costs 28 kopecks”.

My mom gave me the requested sum. On my way home, I bought four portions of the ‘Snowflake’ brand at seven kopeks apiece. I devoured three of them right away and took the fourth home to show my dear mother. When I got home I proudly announced: “Here’s the ice cream. I’ll have it after lunch.”

- Did your dear mother ever learn the truth?

No. But I still blush with shame at the thought of having deceived her…

Here is yet another example of my mother’s influence. In high school, I had a burst of creativity and started writing short stories. I put one of them in an envelope and sent it to a literary magazine called Youth under the alias of Leonid Zoyev. I did not want our family to be somehow associated with it. Nor did I tell anybody about this experiment.

To my surprise, I got a phone call from the editors and was invited to come in for an interview. Viktor Slavkin, who would later become a successful playwright, told me that I did a good job and advised me to make some minor changes. The story was published. Not a single person at the magazine had any idea whose relative I was. Really, it was totally random!

After that, having realized my knack for writing, I began to study works by Ivan Bunin and Yuri Kazakov, their wonderful descriptions of nature in particular. I tried really hard to find equally expressive literary tones and use them in my stories. I kept mastering the skill of writing, although by that time I had already won several top prizes at nationwide biology and mathematics contests.

One day, I mustered up the strength to tell my mother that I would like to apply to the Literature Institute, because it was my dream to follow in her footsteps and become an author. I even showed her some of my works. Then we sat down face-to-face and my mother began to explain that I didn’t need to get a degree from this institute to make a name for myself in literature. It would be far better for me to master some profession first. And she mentioned such examples as Vasily Aksyonov, Daniil Granin, Arkady Arkanov, and Grigory Gorin. An author’s talent does not come from a college diploma in this major. My dear mother sounded convincing enough, so I dropped the idea of getting into the Literature Institute.

- Have you written anything else since?

I went on writing for a while by force of habit, mostly for myself, without trying to have the stuff published. Then I felt there was not enough time for this hobby and I had to give it up. However, to tell you the truth, when they bring me some piece penned by our marketing service, sometimes I can’t resist editing it. One day my father told me: “Stop it. Of course, you write better than they do. But this is not your job.”

- What remarkable personalities your parents are! Your mother talked you out of becoming an author, and your father dissuaded you from becoming a biologist.

Experience shows that both of them were right. It is true that at the age of 12-13, I loved running around with a scoop net in hand catching butterflies, collecting bugs, making professional collections, or attending meetings of a club of young biologists at the Moscow Zoo and participating in contests… One day my father had a serious talk with me. His main argument was that biology is a descriptive science, so there is little room for discoveries. Physics and mathematics are quite different. Consequently, I put forward a compromise - biophysics – and my dad approved.

In the end, I applied to the physics department at Moscow State University, with my hopes set on the biophysics section. It was the tops in the country. I couldn’t make the cut. My nationality did not let me get in.

- Your Jewish roots?

It’s quite remarkable. Back then people with the ‘wrong’ [nationality] item their passport’s fifth line still had chances of securing admission to the departments of mechanics and mathematics, chemistry and soil biology, though with some difficulties. As for Moscow State University’s department of physics or the Moscow Engineering Physics Institute, there was no chance for them at all. I witnessed my classmate Alexander Velikovich, a member of the Soviet Union’s national physics and mathematics team, being tormented in an exam. He was a genius! Alexander was seeking to enroll in Moscow State’s physics department. He was handed a “no good” verdict in the verbal mathematics examination. Just to make him give up hope. I was given a ‘satisfactory’ mark. In the end, I fell one point short of the minimum required for admission. For the first time ever, I encountered outrageous demagogy. Every single word I pronounced at the exam was turned inside out. They were trying to make me look like an idiot. The teacher was talking to me the way an interrogator talks to the accused…

- Did that get you down or cause any despair?

It was an unpleasant experience. There’s no denying that. Eventually, I applied to and was admitted to the department of applied mathematics at MIIT, currently known as the Russian University of Transport (formerly Moscow State University of Railway Engineering). There were two very strong mathematical departments –mathematical analysis and higher mathematics.

- What year was that?

1968. We had absolutely wonderful teachers. The legendary Yelena Ventsel was my academic advisor. She is also known under the pen name I. Grecova (an allusion to letter Y of the French alphabet). She was a talented writer and outstanding mathematician, who authored books on probability theory and operations research, which we all used for instruction.

- How old were you when your parents got divorced?

Twelve, I think.

- Was it a tough disappointment?

Not at all. My father certainly loved me, and I loved him. Just as my mother, he was immersed in his professional interests. He was working on automated systems and computer technologies. His participation in my upbringing was sporadic. He would offer a piece of advice when he thought it was worthwhile. In fact, he began to notice my existence by the time I was already ten. Before that, he would come home from work exhausted and fall on the sofa with a newspaper. If I tried to pop in for a chat, he would tell me: “Will you be so kind as to close the door on your way out, please?” One day he commented with a smile: “Leonid will be of interest to me when he knows how to siphon gas from a canister into a car’s fuel tank.” My father would never intercede on my behalf when I was bullied by older boys in the neighborhood. He said that I had to learn to defend myself on my own.

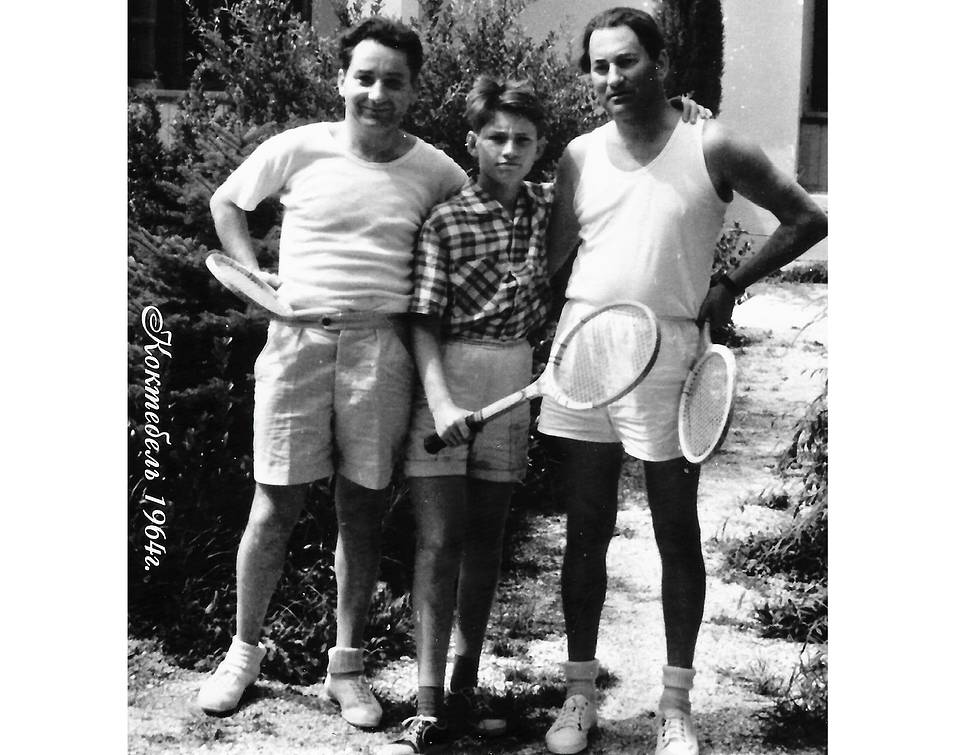

But later on, he let me spend a lot of time in his company. He took me on hiking trips to the Caucasus and Crimea. When I was in high school, and later, as a college student, I would visit him every other day and we had very serious, professional discussions as two adults.

- What was the role of Andrei Voznesensky, your mother’s new husband, in your life?

I was rather indifferent when he entered our life, although he was a renowned poet by that time.

Voznesensky never tried to get on friendly terms with me or take care of me somehow. Only on one occasion – shortly after he joined our family – he took me to a pet market to buy a gift for me. Perhaps, he did so according to my mother’s advice. I chose a chipmunk…

Strictly speaking, Voznesensky was not interested in anything apart from his poetry and my mother. I was an extra.

On the one hand, I felt somewhat offended, but on the other hand, I was eager to earn his attention and to be of interest to him. To develop as a personality and to prove that I was worth something. I can remember how angry I used to get when I would hear somebody say: “Leonid’s stepfather is the poet Andrei Voznesensky.” It was important for me to become successful and self-sufficient and to achieve something in life. I tried to be independent from my mother and from my stepfather.

A funny thing happened just recently. An acquaintance of mine met my mother in an elevator when they both visited a medical clinic. He told her: “I know you. You are Leonid Boguslavsky’s mother.” My dear mother glared at him and asked: “Has my son become more famous than I have?"

- That’s a good one!

Perhaps, it’s my parents who taught me to be competitive back in my childhood. Sometimes it may even seem really amusing. When I go into a steam room and see other people there, it is a matter of honor for me to be the last to exit. In a gym, I will never be the first one to step off the running track, if there is somebody training next to me. At the subconscious level, it has always been important to me to set my target as high as possible and then reach it.

- Has Voznesenky ever asked you to call him ‘daddy’?

Never. I’ve always had my real father. He’s never dropped out of sight. For some time, he even led the marketing department of an IT company I had established. He was my subordinate.

- Did it work?

All went well. My father was close to 80 then, but he worked with great pleasure. It was like a breath of fresh air for him. Then I sold my company to PriceWaterhouse. My father’s services in the new organization were redundant and he left for the United States to join his new family – his wife and step daughter.

In honor of his 90th birthday, I published a book about him. It’s called Boris Kagan. It is a transcript of his memoirs that I literally forced him to record on tape. My father was an outstanding personality. During World War II, he was awarded the Order of the Red Banner of Labor for inventing an automated system of weapons control to be installed on combat aircraft. He was 24 then. He worked as a designer and engineer, and later as one of the founding fathers of the Soviet Union’s computer technologies.

- Was the book published during his lifetime?

Yes. And for his 95th birthday I filmed a documentary about him. I flew to Los Angeles especially for the occasion and hired a cameraman from Hollywood, who captured us having a chat and taking a stroll on the beach… The anniversary celebrations were in Moscow. My father flew in from the United States for the occasion. And six months later he died in Los Angeles. I visited him one month before he passed away. He was in the hospital and already had problems recognizing his relatives. During the war years, he had tuberculosis. A relapse occurred decades after. Everybody had already forgotten what the disease was like. For a long time, the hospital’s medics were wondering what was going on with their patient. My father was losing weight and strength. When the doctors realized what was happening it was already too late. His body was already exhausted beyond recovery…

Now I’m finishing a book about our family history. So far, I’ve managed to dig into the past, going as far back as the middle of the 18th century. My elder children are very much interested in it. And it is important for me to let them know their roots.

- Incidentally, why did you pick Boguslavsky, and not Kagan, as your family name?

It was my parents’ decision. They made it as soon as I was born. Possibly, my mother did not want the name to disappear from the family’s history altogether. She was an only child, while my father had a brother, Yuri. Incidentally, his son Maxim’s last name is Kagan.

- You’ve preserved the memory of both your own father and your stepfather.

Yes, the Voznesensky Fund and Cultural Center were created as a token of respect for Andrei Voznesensky and my mother. That’s another topic for discussion.

- And you purchased a home for yourself near the suburban community of Peredelkino to be closer to your mother.

I’d started building it when Voznesensky was still alive… I hoped they would agree to move to more comfortable accommodations. My dear mother flatly refused. She would never stay in my house, not even for a single night. Never! In spite of the fact that there is a special room for her in the house… My mother needs the spirit of the place where she and Andrei spent so many years together. It is her family nest. When we are finished with this interview, my dear mother will come over for dinner. When I’m in Moscow, we meet every other day.

- Could you give us the details on how the Voznesenky Cultural Center got started?

Following Andrei Voznesensky’s death, a presidential decree was handed down to memorialize his name, namely through, a library, a grant and a plaque on the house where he lived. A museum was on that list, too. But finding a building for it was a problem. The administrators were unable to offer something decent. Yet they were obliged to report the decree had been acted on… In a word, they gave us a tiny room in a common literature museum. Then, I made up my mind that I would do everything myself and I purchased the building.

- Legend has it that you and your mother were walking down the street and she said: “Honey, I like this one.” And her loving son knocked on the door and said without bargaining: “Would you giftwrap this for us, please?” The purchase is rumored to have cost you $25 million.

Sounds marvelous, but it’s not true. I looked at many options. The house on Bolshaya Ordynka Street appeared to be the best. It was a mansion that belonged to Staff Captain Yevgraf Demidov once. A 19th century wooden building and an architectural monument. The previous owners had fully renovated the house before putting it up for sale. The whole structure was taken apart log by log and then reassembled and trotted out for sale. Eventually, we redid the whole space inside.

You’ve asked me about the price: the whole thing cost $4 million.

- Does your mother still say that it is inappropriate to talk about money?

It is wrong to look into somebody else’s pockets and to show off one’s material wealth in public. I recall the inner discomfort I felt when I saw my name on Forbes’ list for the first time. It was in 2012, if my memory serves me correctly, after Yandex’s IPO. I did not need the limelight at all. Being on the Forbes list entails some side effects: anyone who comes into view begins to be shadowed by the media, and journalists start counting your money now and then. Just recently they’ve published statistics showing who in percentage terms were the top earners during the pandemic. I was among the frontrunners. This made me feel very awkward.

- But it is true that in 2020 your capital nearly doubled to almost three billion dollars?

It’s the result of our investment in online services and cloud applications.

In 2012, we invested in Datadog, which monitors and provides security and analytical support for cloud-based applications. At that time, it was a small startup venture. The company developed successfully. The pandemic gave this technological sector, just as e-commerce, online games, distance learning and communication services, a powerful boost. We have many investments in such companies. Once the United States has a successful vaccine against COVID and mass vaccination begins, the shares of those companies that suffered from the pandemic will rebound. I’m referring to the hotel business, tourism, transportation and the retailers … While the sectors that I’ve mentioned as beneficiaries from the pandemic, on the contrary, may lose capitalization.

- Open Sesame! Sounds like you know where the cave with fabulous hidden treasure is.

You’ve got it all wrong! For an investor it is extremely important to understand where technological development trends are headed and the potential scale of projects.

For 19 years – from 1973 to 1991 – I was busy working on the theory of computerized systems and networks and mathematical models. I conducted research into what would eventually become the Internet. At a certain point, I developed interest in practical projects, software development and ways of building systems. I met some talented programmers. We started working on our own software that would make it possible to combine various computers into a single network. The project was a success. That’s how I earned the first $10,000 to establish the LVS company and decided to wrap up my scientific career and go into business.

- Ten thousand bucks in those days seemed like a good sum of money.

Everything is relative. In 1991, I was paid $50,000 a year at the University of Toronto as a visiting professor.

- What brought you to Canada?

The legacy of my previous scientific accomplishments. In the 1970s and 1980s, I achieved some significant mathematical results and had them published in leading foreign science magazines. I was invited to the Department of Computer Science at the University of Toronto. My family moved there in 1991. Although several months before that I had already founded the LVS company and concluded an exclusive distribution agreement with the Oracle Corporation. Becoming a visiting professor at a renowned university was a dream, a long-cherished paramount goal for any Soviet scientist. You start working side by side with colleagues whom you have known indirectly, through their scientific articles. It was very hard to reject the invitation. At the university, I had an office of my own with my name on the door. Everything looked fine.

- Has the idea of emigrating ever crossed your mind?

Never.

Besides, in Moscow I still had my own company. At a certain point, I felt that I came to a fork in the road: It was either science or business. After two months of lecturing at the university, I suddenly realized that I was no longer interested in doing math problems. That’s another key feature of my character, I find it boring to defend and stand by what’s been achieved. I need some new goal, some new challenge, something that pushes you forward. At the university, I realized very clearly that my main objective at that point was to avoid making any enormous blunders until retirement, to publish a couple of articles with average scientific results every year and I’d be living large at the end of the day. I don’t consider myself to be a talented mathematician. True, I managed to achieve noticeable success at the start. I had every chance to capitalize on my past successes and I could have coasted along thanks to my scientific achievements, defending what's mine.

Psychologically, it was a difficult time. My deputy whom I had left in Moscow to run the company stole money. Two top specialists who had worked for LVS established their own company and went to Oracle with the aim of taking over our distribution agreement…

I decided to fly back to Moscow. I approached Ken Sevcik, the department chief, and told him I was returning to Russia. My boss thought I was out of my mind.

- His surprise is easy to understand.

I flew back to Moscow in December 1991. Several months after the August coup. Piles of garbage were being burned on Okhotny Ryad next door to the Kremlin…

- And there you had a yearly salary of $50,000?

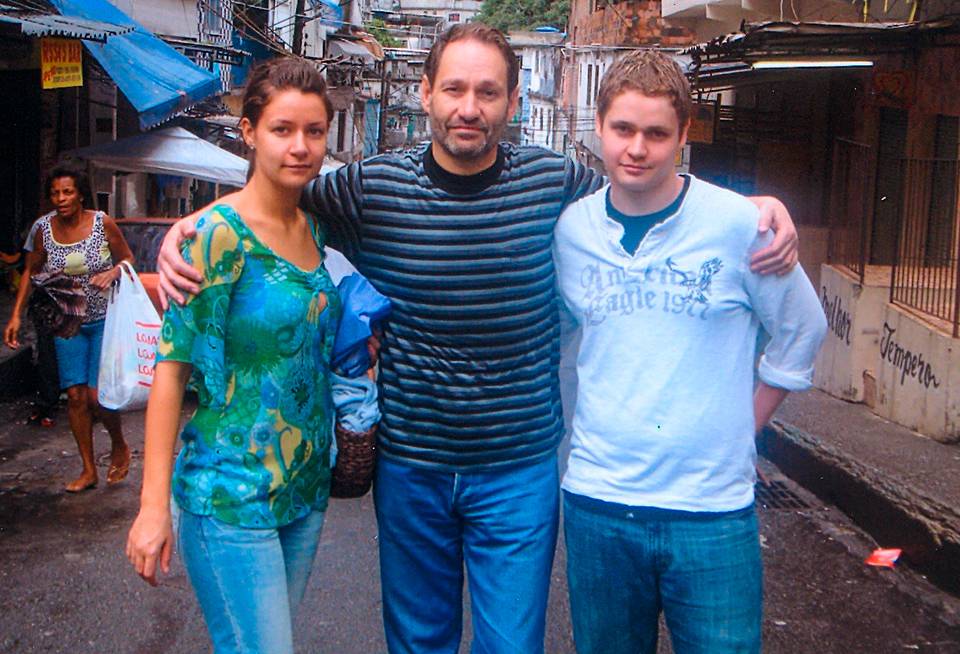

When Sevcik realized I was not kidding, he said: “I’m certain you’ll change you mind and get back soon.” Also, we were supposed to complete a mathematical research project and write an article. Ken left me half of my salary. My wife said the money would be enough for her and our two children to live on. Marina refused to return. In Moscow, she had recurring allergic reactions. In Canada, they disappeared. Also, our daughter Anastasiya, had already started going to school in Toronto and our son, Dmitry was set to start school the next year…

- The family boat ran aground off Canada?

No, Marina and I have remained on friendly terms, although life has caused us to drift apart. After all, people must live together to remain a family. My trips to Canada were sporadic and brief. I was spending most of my time in Russia. We still reunite once or twice a year to go on vacation. Besides, I’ve had another family for many years, with two little kids growing up. Sometimes we all get together.

The University of Toronto paid me my salary for a couple of years. I continued to do something for them, but then I came to my boss and said: “Ken, I’m not working as hard as I should. I feel uncomfortable when I get the money that I’m being paid. So, let’s be over and done with it.”

I earned my first one million dollars in 1997, when I sold the LVS company. I was 46 then. As I’ve already mentioned, I started with ten thousand dollars in capital. The business was developing slowly but surely to a point where LVS joined Russia’s top three IT companies.

- You must have been a little bit dizzy with success.

What makes you think so? I never regarded myself as a big business tycoon. I was always interested in implementing intricate technical projects. In 1994-1997, LVS created a system of housing privatization in Moscow. We built a computer network infrastructure for the State Duma and introduced an automatic passport control system in Uzbekistan…

The 1990s had been a time when private enterprise was thriving in Russia. Everybody had different experiences, of course, but I am certain that many businessmen from those years are real heroes. They created whole industries and branches of the economy.

When I sold LVS to PriceWaterhouse, I became a managing partner and head of its Management Consulting Services (MCS). Then as an Internet specialist, I was made chief of the electronic business division for Central and Eastern Europe. This allowed me to be immersed in the Internet industry and participate in world conferences, in addition to meeting with fellow entrepreneurs.

I had a very large salary. Also, I was guaranteed a substantial lifetime pension, if I stayed with PwC well beyond retirement. In 1999, I realized, though, that I had achieved all that I could in that company and that all I was expected to do was to carry on my day-to-day functions out without making any mistakes. Things would coast along all by themselves. I’m not accustomed to this lifestyle.

This explains why I started making investments in Internet companies and looking for a chance to set up my own business. In December 1999, I got acquainted with three investment bankers – Michael Calvey, Charles Ryan and David Mixer – who were making plans for building a large investment company. At the very first meeting, I made up my mind to join them. I invested all my money that I had at that moment - my own one million dollars and another $500,000 that I had borrowed from some people I knew well enough - into ru-Net Holdings that we founded.

Then I told my PwC partners that I would like to leave. I was asked to stay for another year and prepare a substitute. I quit in March 2001 to become in charge of ru-Net Holdings. My new salary was one-third of my previous one.

We poured investments into Yandex, Ozon, Tops, and some other companies.

In 2006, I split the assets with my partners and ended up with a nice portfolio of stakes in all the companies we had invested in over the years. In 2011, after Yandex’s IPO, my assets were worth $400 million. Then I got down to working on my dream that I had had since the early 1990s, which is building a global company. We opened an office in New York and started making investments in Europe and Asia. There were some successful projects. Five of our companies turned into multibillion-dollar enterprises. Now, we have offices in India, the United Kingdom, the United States, Singapore and Cyprus and investments in 12 countries.

All that I have today took 30 years to build.

- Was it important for you at some point to outdo, or outshine the renowned big business tycoons?

Let’s leave them alone. Personal wealth has never been my ultimate goal. Honestly. But it is really fantastic to see members of your team become multi-millionaires!

I’ve long dreamed of creating a complex project, of developing a crucial technology. This is far more important than the millions you have in your bank account. I have always directed my efforts towards achieving a tangible non-cash result. Whether it's proving a difficult math theorem, building a company based on the best practices, or building a strong team of like-minded people. These are the goals I’ve always worked for, and with that, my financial resources were gradually increasing. That’s how it all happened.

Although I must confess that I did make mistakes and suffer losses.

- How often did you stumble?

Often enough. But I always told myself the bruises that I was getting were paid lessons. Back in my younger days, I convinced myself that any failure may be of great value; it has to make you stronger. It’s no use getting nervous or desperate. It’s far better to learn by experience so as not to repeat those mistakes.

In some cases, I lost money, a lot, in fact. There were incorrect investment decisions and mistakes in selecting partners who eventually proved to be weak or fraudulent.

- How did you react when you were cheated or backstabbed?

I’m probably not a typical businessman, and definitely not a predator. Whenever I came across any duplicity, I did nothing, and just stepped aside. I’ve always been certain that my emotions and time are worth spending on some new project, and not on settling old scores. I’ve never gone after those who deceived or defrauded me. I simply let go of the situation and turned my back on those people.

Of course, I gained experience that enabled me to minimize such mistakes in the future. I started paying greater attention to some peculiarities of people’s behavior that I had ignored in the past.

For instance, I often thought that the people I was communicating with had the same mindset or felt the same way I did, and that they were like me in many other respects. That they shared the same ethical views. But all people are different. This should be accepted as an axiom. Otherwise, your expectations may be disastrously wrong.

You’ve got to have a strong and reliable team. I believe this is the most valuable of all assets that I have. I owe my success to the people who work together with me. It is not a beautiful gesture, but a reality. The team makes all the decisions. I seldom intervene.

One more thing, you should have people on your team who are stronger than you in some respects. They are to complement each other. That’s the prerequisite of success.

- How many people are there working with you?

About 30 around the world, if everybody, including the secretaries and administrators, are counted. At the beginning of this year, we launched a third fund RTP Global. It is three times bigger than its predecessor, so we expanded the team on all continents where we operate: the Americas, Europe and Asia. This is our main task.

Each contender for the position of a partner undergoes several interviews with other members of the team on Zoom. And we try to meet the applicant in person before making a final decision, although it is not very easy to do these days. I’ve met with a new European partner in Italy, and a new American one in Mexico. The main requirement is that the individual matches our personal and professional culture, has personal investment experience and some accomplishments. Some key members of the team joined me 15-20 years ago upon graduation from universities starting out as junior analysts. We’ve grown together.

- Are there many compatriots?

They are in the majority for the time being. Although in the United States, Europe and Asia we invite local professionals.

- Does the ‘Russian businessman’ label still haunt you?

There’s no way of escaping from it. A Russian businessman has great problems with making investments abroad. In particular, in the United States. But there is no big problem for us by and large. We have to present many documents to prove the origin of our capital. Foreign banks have scrutinized my earnings since the late 1980s. The successful reputation I’ve earned abroad over the years does a great deal to help. The funds we cooperate and coinvest with, and the founders of companies where we had or still have stakes provide favorable recommendations. The move to create an international investment entity made back in 2011 was a winning decision. It would be far more problematic to launch such a project nowadays.

- You have not yet mentioned any unicorn companies that relied on your assistance in building up capitalization to one billion dollars.

Five public companies where we were early stage investors have gone through multibillion-dollar IPOs: Yandex, Delivery Hero, RingCentral, Epam and DataDog. In our portfolio of investments there are another three unicorns. But let me repeat, it was essential that in 2011 we entered the foreign market while making investments in Russia simultaneously. For a long time, I’d thought about building a strong international company. At first, I hoped to do that in IT business projects, and in system integration. But then I realized that my chances there were bleak. Now I’ve managed to see my dream come true in the professional investment segment.

We enjoy a good reputation. We have never acted against companies’ founders or other shareholders. This enables us to work normally. Although the market knows very well that our money is Russian. Even the fact that I hold a seat on the observer council of Russia’s state-controlled Sberbank is an extra headache for our fund.

- Wouldn’t it make sense to quit then in order to make life easier?

For the time being we’ve been sorting out the emerging issues, but we have to spend more and more time on them. Sometimes it takes months to open accounts for our companies in European banks. We have to undergo checks and obtain some authorizations. Before everything was done much faster.

- Are the effects of Crimea making themselves felt? What do you think?

I’m in no position to judge. But Russia’s foreign policy certainly does not make our work any easier. We still want to become a major international player. We’ve been growing slower than we could, but quite successfully.

- So far, you’ve described in detail the way we are seen in the West. But there is another side to that coin – the investment climate in Russia. How would you describe it? Frigid?

The two crucial elements for an economy’s development are entrepreneurship and investment. The situation is better in countries where business people, investors and civil servants join forces for the sake of developing priority industries. Businessmen are the key figures in this respect. There are some countries in the world where political freedom is missing. Yet the economy flourishes successfully thanks to freedom of enterprise. There are well-known instances like, China, Singapore and Chile, at a certain time in their histories. Growth and development are not possible, if there is no political or economic freedom.

Russia’s economy is a market one by and large, but it is not free.

- What is still missing?

Economic freedom implies a certain attitude by the authorities towards entrepreneurs and investors. Here are two examples of how countries reacted to an external event as a challenge and in response provided government financing focusing on business.

The Soviet Union’s launch of the Earth’s first satellite was a slap in the face for the United States. As a result, a mixed public-private program was drawn up with the net effect of Neil Armstrong setting foot on the Moon 12 years later. Then, the emergence of the Internet followed.

It was the correct response to the gauntlet being thrown down. The US created a network of computer research centers at its universities. That’s how global computer networks, the Internet and thousands of private IT companies were brought into being.

The other example is China. Just recently, in May 2017, a deep learning computer software from the British company AlphaGo scored an overwhelming victory over the world Go champion in three marathon matches, in front of hundreds of millions of viewers.

At the state level, Beijing took this as a challenge. Within a couple of months, China’s State Council adopted a program for artificial intelligence development to the tune of roughly $150 billion dollars. Two years down the road, thanks to government investment, money from private foundations and an entrepreneurial boom, the amount of China’s venture investment in this sphere had been boosted to about 50% of the world’s investment in artificial intelligence. At this point, it wouldn’t be an overstatement to say that by 2030 China will become the world’s AI leader.

- Business people were given the green light?

A powerful public awareness campaign to encourage mass enterprise is needed. In China, after the prime minister’s speech on the importance of this issue, civil servants at all levels, including municipal functionaries, did their utmost to help businesses make rapid headway. A vast campaign was launched in the mass media and each big city saw the emergence of technoparks and startup incubators. I visited China several times over the past few years and each time I was astounded: 80% of young Chinese want to go into business. It’s prestigious! The Chinese authorities do not permit political freedom, but they funnel the energy of the country’s youth into private enterprise. Young guys launch projects and companies and try to think up something really awesome that would let them feel like real heroes, like sports or film stars. People like them make a country successful. A nation that does not adore and admire its businessmen will never succeed.

Russia has great business potential, big enough to let it compete with the United States.

- But there is nothing to take special pride in yet, right?

Economic freedom requires genuine government protection of private property, a crusade against corruption, free market pricing, effective privatization, a top-notch macroeconomy, and putting the consumer before the producer and the regulatory system. The latter is essential not only for businesses where the client is of paramount importance, but for all industries. In the healthcare sector, the focus must be on patients, in education, on students, in science, on researchers, and in sports on athletes… It is not civil servants, administrators and functionaries that are the real consumers. True, freedom is not an equivalent of permissiveness. That’s what various regulations are for. But such regulations must be independent and serve the interests of the market, and not cater to somebody’s political or private aims.

It seems like our government lacks the authority to develop a free economy. As a result, Russia is losing its technological edge, investment attractiveness and human resources in many industries.

Why are privatization and private enterprise so important? As a rule, the management of public companies does not care about profit and capitalization. It is far more concerned about investment programs, huge budgets and cash flows. In the 1990s, many wished to privatize not so much the companies as the money they were getting. Money was successfully siphoned off even from enterprises’ expense and loss accounts, let alone profit accounts. Regrettably, this is the type of situation that we can often see these days.

- Have you come across such cases yourself?

Here is a story I’d like you to hear. A Russian company in which we had a stake was developing and implementing IT systems. One large government organization was on the list of its clients. When that government organization’s management changed, I got a call from a well-known businessman who asked for a meeting.

Upon arriving at the office, I saw one of the newly-appointed chiefs of that public company seated at his desk. That individual told me outright without much ado that the new bosses were all his righthand men and the controlling stake of our company must be re-registered in his name. Otherwise, all contracts would be terminated and the acts of delivery and acceptance of work performed would not be signed. The public company’s official explained in very plain terms that only businessmen they “know well enough” can count on being their contractors. Indeed, work was halted. The same happened to other contractors. Builders were the hardest-hit. The signing of delivery and acceptance acts was frozen and some bankruptcies followed. It was our good fortune that that top manager received orders from on high that brought him down a peg. But some businessmen had already yielded to this pressure.

Incidentally, later on when some other businessmen “well-connected” to the company’s management took over, the contractors were reshuffled in the end anyway.

- To put it in a nutshell?

This merely illustrates how important privatization is for the economy to develop effectively. It is common knowledge that in many public companies the contractors are told immediately what their “homework” is: in other words, the share of the contract money that is to be transferred to “where they will be told.” This explains why there is no free competition and why only businessmen who are “well-connected” can stay afloat. Very often their companies, lacking the required competences, hire professional subcontractors, but by no means do they allow them to work with the client directly, and consequently even drive them into bankruptcy, because of underpricing. While the profit margin stays in the pockets of the middleman that acts as the general contractor.

Let me say once again, free competition and the investment climate are essential for the entire country.

And when investors begin to be arrested on some dubious charges, it’s a real disaster. Everybody knows the names of Michael Calvey and his partners Alexander Povalko and Mikhail Khabarov. Very few in Russia these days will dare accept investment money from the state. That’s another aspect of the lack of economic freedom.

Promoting private enterprise and encouraging talented businessmen who have built successful and well-known companies from scratch is a complicated task these days. But it has to be tackled. Hi-tech centers must be created in St. Petersburg, in Siberia, in the Far East and in Russia’s South. There should be more Skolkovo analogues enjoying special privileges, such as extended tax breaks and having a free hand in hiring foreign specialists, who may be eager to come and work here.

But the main condition is a ban on preventing law enforcement agencies from victimizing the residents of such centers. And not only these, but any businesses and investors in general. Efforts to persuade them not to crack down on businesses are not enough. Real mechanisms preventing such crackdowns must be established. For this, the key performance indicators of our law enforcement agencies must be revised. Currently, their effectiveness is rated by the number of criminal cases launched. For now, it’s a box-ticking system: the more jail terms there are, the faster the careers are made. Their main concern should not be on sending someone to jail, but rather protecting private property. Some economy-related articles of the Criminal Code must be amended and jailed businessmen and investors amnestied. After all, there is a special article in the Constitution to the effect that the state protects private property.

- Have you ever been targeted yourself?

I have. I still do not feel protected well enough. In Russia, many business people are forced to waste time on protecting themselves from infringement and persecution. In no other place around the world – the United States, Europe or Asia – have there been any situations in which we had to go and ask for something from the authorities.

- You have been very careful in choosing euphemisms so as to avoid pronouncing the word “corruption”.

I’m not just focusing on that. Very often legislation and regulatory acts are the stumbling block.

- Which lets corruption thrive.

Right. Sadly, this is one of the side effects of the lack of economic freedom. The risk of getting within the range of corrupt interests and some officials and so-called law enforcers is on the rise.

- How can this vicious cycle be broken?

There must be economic freedom. I’ve already mentioned its components, with a genuine war on corruption being the most important of all.

- Do you really believe in what you are telling me?

We are not discussing beliefs, but action. You are asking me and I’m trying to provide an answer on where I see a way out…

- Are you still in no mood for changing your geolocation?

I was born in Russia. My motherland is here. So are my mother and my family. But I have no permanent place of residence. I’m a digital nomad, if you wish. Professionally, we are represented on the global investment market. I fly a lot. This is part of my job.

- Did you stay in Moscow during the coronavirus lockdown?

For the most part, yes. Of course, the pandemic brought about certain adjustments to my schedule. Although I must admit that the effectiveness of our corporate Zoom conferences has even improved, yet the duration has been shortened by 25%-30%. Meanwhile, the quality remains the same.

As far as personal matters are concerned, several important cultural events and a number of sporting competitions I had been planning to take part in were canceled. In March, there was going to be a cycling get-together with my friends in Portugal, then a cycling race in Majorca, the Oceanman swimming contest in Italy and a yachting race. All those plans fell through.

In 2017, we founded an international sports project – the first-ever commercial Super League Triathlon. It is for the elite of this sport – world and Olympics champions and medalists. As before, there is cycling, and running, but we have invented new types of races – short and dynamic. It’s become a real thrill to see the triathlon live on TV. Our races are broadcasted in 150 countries. The pandemic ruined the whole season. We had had plans for stages in England, Malta, and Singapore, Saudi Arabia, and the United States. Sadly, all of them had to be called off. But in August, we managed to hold a contest for the top athletes in Rotterdam. We placed exercise bikes and running tracks inside a swimming pool and used many of the latest technologies. And the Zwift system (incidentally, we are among the company’s investors) projected all contestants’ avatar images on to a huge video screen, which also showed their real position on a virtual track, depending on how hard they worked on the training machines. And at the edges of the screen, the spectators could see the athletes’ current speed and capacity. Top technologies enabled us to divide up the administration of the contest among several centers. The athletes were competing in Rotterdam, the director and manager of the show were in London, the operators in Singapore were responsible for the infographics, and the sports commentators were in Australia. The show turned out to be sensational.

What else can I say about the bright side of life? In August, I became a granddad for the first time.

And my son Dmitry got married in October.

- What do your children do?

My eldest daughter, Anastasiya, has a startup project. Together with a partner she came up with an idea of cordless hair tools for women.

- Do you support the project?

Mostly with some advice. I believe that she should be in a real market economy environment. The company should be developing from the money that independent investors provide, and not from family money.

Dmitry and his partner run a seed stage investment fund. Small sums are invested in startups at the very early stages.

- Your son is a triathlon enthusiast just like you, isn’t he?

At first, he would come several times to see me compete and root for me. It was a kick-starter. I suggested that he could have signed up for a race himself, too. There were still four months ahead, I told him. You might perform well enough, if you start training right away. Dmitry replied: “Dad, I’ve already applied.” He did two full Ironman sets together with me.

Do you know what it is like? It involves 3.8 kilometers of open water swimming, 180 kilometers on a bike and the classical 42-killometer marathon race. My boy did it in 12 hours. My own best result is 11 hours and 30 minutes. The world record – 7 hours and 35 minutes – belongs to Germany’s legendary triathlete, Olympic champion Jan Frodeno.

- When did you become interested in sports?

I dreamed of becoming a famous athlete back in my childhood. In the first grade, I was taken to a swimming lesson, but right of the bat the coaches said that I was no good and suggested that I try out at the diving section next door. There I was asked to leave the next day. I also tried tennis, football, track-and-field athletics and cross-country skiing, but each time I was either rejected or dismissed within a few days. I had problems with coordination and was very slow. During Phys Ed class in school I was always among those who clocked the worst time in the 100-meter dashes. Not only did the boys outrun me, but half or our girls were faster than I was.

What all the coaches overlooked, though, was my great, innate endurance. In the 10th grade, we had a three-kilometer race. I took second place in my school, because I my moved my legs just fast as I did in those 100-meter dashes.

I gave up my attempts at sports, but the dream of becoming a champ must have become deeply ingrained in my mind. By the time I had already reached 62 years of age, I read a book by an Australian athlete, Chris McCormack, entitled I’m Here to Win. He is a great triathlete, a four-time world champion. The person who gave me the book as a gift told me: “Don’t pay attention to the sports side of it. It’s interesting from the standpoint of goal-setting and willpower. Both are important for a businessman.”

The book is excellent in this respect, but it also sparked something deep inside me. I asked myself why don’t I try to go to some gym with a swimming pool for an endurance test.

You must remember that at that time I could only swim ‘dacha style’, in other words, the backstroke. If I attempted to do the front crawl, I would be gasping for air after the first ten meters. As for cycling, the last time I was on a bike was when I was 14. Yet, I set my sights on tackling the Olympic triathlon program: swimming 1,500 meters, biking 40 kilometers and running 10 kilometers.

I went to an athletic club, got into the swimming pool, did 1,500 meters somehow, then I got dressed, went to the gym and tried to do 40 kilometers on an exercise bike. After 20 kilometers I felt it was getting really hard for me. My backside ached the most. The lack of training made itself felt. I clenched my teeth and eventually pulled through, nevertheless. Then I stepped onto the running track and jogged 10 kilometers. When it was over, I felt euphoric. I did not give up! I did it!

I felt enthusiastic and determined to improve the result. I found a triathlon coach and started training. Then a really amazing event happened. Several months later, I went to a contest in Miami to complete half of the full Ironman. I swam 1,900 meters, rode 90 kilometers on a bike and ran 21 kilometers. Then I packed my things and headed for the exit from the park where the contest was being held. Suddenly, I heard the announcer call out my name. Imagine that, I was invited to the award ceremony. I took third place in my age group. The last time I felt that ecstatic was after winning a Biology Olympiad at school!

- Or after making the first one billion dollars.

No. When I was standing on the podium in Miami, I was on cloud nine. As for the billion bucks, it left me totally indifferent. I’ve already explained to you my attitude to money…

- But does comfort matter to you?

For the past ten years, my friends and I have been in the habit of making annual trips that could be called expeditions, because they are rather grueling and the route is barely passable. For instance, on one occasion we rode through the dense taiga forest along the Tatar Strait in the Khabarovsk Region. Also, we crossed the Lena River’s delta in northern Yakutia. And last August it was Koryakiya – 11 days from the Bering Sea to the Sea of Okhotsk.

We used the Sherp all-terrain amphibious vehicle, capable of surmounting large stones and fallen tree trunks. Also, these off-roaders are capable of developing a speed of five kilometers on the surface of water.

We slept in tents or inside the Sherps. All these vehicles are equipped with built-in foldable beds. In the daytime, the vehicle’s body can be loaded to capacity. When we stop for the night, the beds are pulled down, providing enough room for two.

- Did you see any bears?

Many times. They often show up on river banks. We usually stretch out a high-voltage live wire to poles surrounding the camp at night. Just in case…

I have a ritual – I swim in every sea that we travel to. This time it was the Bering Sea and the Sea of Okhotsk. The temperature of the water was +12C.

Does that answer your question about comfort?

We have a very remarkable group of people. Each one is a professional in some field. While sitting around an evening campfire, we usually lecture each other on various things. For instance, I brief them on artificial intelligence and various technical solutions, while others dwell at length on green power or the development of liberalism in Russia. It all goes down perfectly with a shot of vodka.

- How about fishing and hunting?

We never take shotguns with us. As for fishing, it is wonderful. I love fishing and usually catch a lot. This time I caught a white-spotted charr, a dog-salmon and a grayling.

- What’s your personal record?

On the Kamchatka Peninsula, I often catch Chinook salmon. One day it was a huge fish, 25 kilos or so. It took me half an hour running along the shore back and forth to prevent it from breaking the line. It was a very strong opponent and kept on struggling incessantly.

- That’s when your good physical shape came in handy.

I’ve always been in good shape, thanks to the triathlons. In 2015, I was even selected for the Ironman championships in Hawaii. I came in second in the contest in the US. But I was not destined to participate in the world championships, though. Two months before the event, I was badly injured during a multiday cycling race in France. I had to undergo an implant surgery and two weeks after leaving the hospital I ended up breaking that same leg’s thigh-bone. More surgery followed…

- To my recollection you skidded off a road into some ditch…

No, I had a plain fall. But that was enough. As for the other bone fracture, it’s a result of my own foolishness. I went ahead with my training in Italy, since I wanted to compete in Hawaii in spite of the implant. One day I decided to take a swim, though the sea was rough. A powerful wave hit me and the steel rod in my thigh broke the bone. The second operation was far more serious. An intricate piece of hardware had to be used. But I was determined to prove myself and the doctors that I won’t give in. Five months later, I was already competing in the full-scale Ironman contest in North America in Texas. I finished with success.

- Are there any other such precedents?

Yes, as many as you wish! At that multiday cycling race in France where I ended up with a broken leg, there was a contestant whose leg was amputated below the thigh, and he had no arm below the shoulder. He used only one pedal. It was a mountain road with steep slopes and sharp turns. True, he was not very fast, but surely not the last and he never fell short of the expected deadline. He crossed the finish line to our loud applause.

There I got acquainted with John Maclean of Australia, who became a paraplegic after suffering a spinal fracture, when a truck knocked him off his bicycle. John became the world’s first athlete with paralyzed legs who performed in the Ironman championships in Hawaii. He swam across the English Channel in accordance with the rules of that contest. Forty kilometers in frigid waters: the temperature was just 14-17 degrees! Then Maclean met doctor Ken Ware who discovered that some nerve fibers in his legs were still alive. Ken Ware is the author of a course of rehabilitation of paralyzed people on the basis of essential tremor therapy. He succeeded in helping John free himself from his wheelchair, after 20 years of having been confined to it. Maclean managed to stand up and walk! He can ride a bicycle again. He even participated in triathlon contests alongside other athletes. His willpower is amazing. Maclean has written a book entitled How Far Can You Go? It was translated into Russian.

- Do you keep training?

Yes. I find it a little bit painful to jog and even to walk around due to that trauma. Nothing can be done about it. I’ve visited different surgeons and orthopedists in different countries. They concluded that my problem is due to the implant, but replacing it again is too risky. Gradually, I’ve gotten used to this pain. And then I suddenly discovered that if I start walking the sports style, it hurts less than when I walk and jog the usual way. I’ve found a coach in Izhevsk, a former European champion in women’s sports walking. She trains me online. My results and speed have been accelerating. I can already do nine kilometers an hour. My goal is to complete the full Ironman competition, where I hope to walk the marathon distance. Perhaps, I will be among the winners in my age group again.

- And what are your business plans?

I’d like to make our RTP Global one of the leading technological funds in the world. Established by a Russian founder. This is quite a challenge.

- How important is intuition in an ambitious undertaking like this?

It is certainly not the most important factor of all. Experience is far more valuable, even from previous mistakes. There are several things an investor should seriously focus on and among them primarily is the team that created the project in progress. It is essential to decide if these people will be able to cope with the task well enough. Any idea, even the greatest and newest one, accounts for merely 20% of the success. The team’s ability to make the project materialize is the key. Thousands of wonderful ideas around the world were buried for the simple reason that the people who embarked on implementing them lacked the skill and competence.

It was not Google that invented the search engine and it was not Facebook that came up social networks. Other companies were the first, but their teams were not strong and effective enough to withstand the competition that emerged later on.

Second, it’s the scale that really counts. That’s where intuition comes into play. Say, a local project, confined to a small niche, may be of interest to its founders, but not to investors who are eager for a hefty return. Each time I do my best to estimate the potential.

For instance, in 2011, together with my partners, we founded and made the first investment into Delivery Hero, a German company offering food delivery service from restaurants. Our inner voice was telling us that this model might have good prospects. If it is replicated in other countries quickly enough, the scale may be really impressive. Delivery Hero is now a well-established company worth $20 billion …

- What’s worth investing in now to make good money?

In my opinion, you either have to start investing seriously and become a professional, or if you have money to spare, give it to successful funds. Making casual investments on your own from time to time is not a good idea. Ninety percent of people lose money this way. It is wrong to invest in one, two or three companies. It’s better to create a portfolio of investments into at least ten companies. Experience shows that one-third of them will go bankrupt and about as many will stay at the break-even point. Some investments will be quite good and only one company will become a bonanza. If you are fortunate enough, of course…

As for the sectors of the economy, we at RTP Global continue to invest in companies and technologies offering software solutions for businesses, cloud services, distance learning, new technologies of mobility, artificial intelligence- based applications and some other sectors.

- In Russia or in the West?

In different countries. There are talented entrepreneurs and specialists in Russia. But very often they manage to display their potential to the fullest only abroad. We’ve already discussed the reasons why.

- Do you set some timeframes for yourself? Have you ever thought of getting away from it all? Next year you will turn 70.

My age group is the most active one. My own mother is an example for me to follow. She is 96, but she goes to the office almost every day to run the cultural fund. I still have someone to look up to and keep up with.

- But at some point, you will have to pass on your business to your heirs anyway.

We have made some legal arrangements to guarantee that should something happen to me, everything will be placed in the hands of my team and my children, who will have seats on the board of directors enjoying equal rights with all the others. I have four children. They will be only part of the group of partners with decision-making rights. Also, there are certain restrictions on the amount of money my children can count on.

- You’ve set some limits?

Yes, everything in excess of the fixed amounts must remain in the domain of business. There are some restrictions regarding expenses on such things as education, housing purchases or weddings. In all cases, the sums in question are very moderate. A small share of profit is reserved for my children’s current expenses. The main capital cannot be withdrawn. The money must keep the company going and developing. This is very important for the members of our team. They have the right to know what will happen, when I am not around anymore. The show must go on.

- Do your children feel disadvantaged?

The young are unable to ask such questions by virtue of their age, while the older ones seek to achieve everything on their own. That’s the way they were brought up. Apparently, just like myself, they are reluctant to be treated as their parents’ shadows…

- Is a businessman obliged to be a risky person?

People differ. I’m not afraid of losing money. I’m never scared to try and fail. This explains why I sometimes take greater risks than I possibly should. Each person has to make dramatic decisions in life. I’ve been in such situations many times. After Yandex’s IPO, I had every reason to say that I’ve been successful in life. I could afford anything I wanted. And by that time, I was not a young man. But I began to invest the money in creating an international company. I ventured into India’s market where the first four investments cost me $20 million. Despite the losses I sustained, I had no intention of leaving the Indian market. By no means. I’d just paid for knowing it better.

- Some people say: “Once bitten, twice shy.”

That’s why I am telling you: “It depends.” There are successful businessmen who prefer to stay very conservative and shun extra risks. I, too, would possibly decide against putting somebody else’s money at risk. What makes the situation so unusual is that most of the money in the fund is mine.

- Do you believe in luck?

Each person creates their own good fortune by managing the space of opportunities. They emerge as a result of meeting other people, studying the information flows and participating in events. From time to time, there may happen to be some important events, and we make certain decisions in response to them. They can lead to success. Not that one person is unexplainably lucky while another is hopelessly unfortunate. Each of us is given certain chances in life, but very often people overlook or miss something very unique and interesting that can make them successful.

Your question has another side to it. Many are reluctant to leave the area where they are quite comfortable today. Very often people fail to achieve success because they are afraid of failure. Only a minority try to grab the chance that comes their way. To catch a fish, you’ve got to bait the hook. This may not happen at once. This merely means you should try again and again until you catch it.

People on our team are all architects of their own success. Last summer, I asked each one the same questions: What is your professional dream? How do you see your place in RTP Global? What are your strengths and weaknesses? All of them replied that they would like to see the company become one of the greatest funds in the world. These guys are prepared to spend at least ten years of their life on achieving this goal. This is a long-term objective.

- Don’t you think you were told exactly what you wanted to hear? What if your subordinates were just seeking to please their boss?

No, we have a different culture. I’m not the boss. True, I have the right of veto, but I cannot recall when I last used it. I’m rather an adviser to the team, a person who voices his opinion, but never presses for it. Should some problem emerge, any staffer feels free to come to me for advice, but before that I expect to hear a proposed solution. We have a high level of transparency of what we do. It is really fantastic when I see the team do its job right without me.

It is important not to feel lost in the crowd and not to cater to others’ views. In school, some of the boys played the guitar, while others were great dancers. I wanted to win some recognition, too, but all my attempts failed. I studied well, I won contest prizes again and again, but in the company of friends I remained a second rater. I recall that in the ninth grade our class was granted ten vouchers for a trip to Czechoslovakia. The teachers decided to distribute them by means of an open ballot. I was number 13. It was a bummer. Many guys voted against me. I reconsidered many things in life and realized that it is wrong to try to woo others. Also, it is essential to find your own way in life and focus on it, trying to be better than the others. And once you’ve achieved some goal, you should immediately set another one. While most people prefer to float downstream.

- While you are swimming upstream?

I’ve always tried to study the best practices and sought to meet those who succeeded in what I was striving for. I would come up to them with a list of questions and start asking them in detail. It was very useful. The main thing is to determine what you want to be the best at. I don’t mean successful, what I mean is the best.

All people, even the most talented ones, can be divided into two groups. There are those who, like some athletes, would like to win a couple of competitions and to make money. This satisfies their ambitions. And there are others, who wish to become legends. Look at our football. Russian players are pretty happy with the money they earn. It’s quite enough for them. Of course, there is corruption that can kill dreams. Who among our star players is eager to become another Messi or Ronaldo? If you’re lucky, you might find a couple of guys in the entire country.

Or take men’s tennis. Its main driving forces are Djokovic, Federer and Nadal. They’ve stopped playing for money alone long ago. Their inner challenge is to become a legend, to go down in history, and outperform everyone in the number of tournaments won.

If our people, who are no less talented than their counterparts elsewhere, learn to have big dreams and believe they can achieve what may look unachievable at first sight, Russia will see many changes for the better.

- As far as I can guess, you’ve set your sights on becoming a legend?

It's not about me personally, but about the team. Correct. We’ve been very good at investing so far. And we’ll keep on striving…

- And to wrap things up, my final question for you is: “What’s your idea of happiness?”

Personal freedom. The right to choose the way I should live, what I should do in life and with whom I’d like to associate. People are often asked whether they want to be happy or have freedom. Many choose happiness without freedom. I should say that I’ve enjoyed maximum personal freedom only over the past few years. I don’t have to meet with unpleasant people that I may need to for some reason. I can do whatever I please. And I can say what’s on my mind. This is happiness.